Concept

Account - the detailed record of all the changes that have occurred in a particular asset, liability or owners’ equity during a period.

Journal - the chronological record of the transactions.

Ledger - the record holding all the accounts.

Trial balance - the list of all the ledger accounts & their balances.

Asset - the resource

- controlled by an entity as a result of past events

- provide economic benefits to the entity in the future

Liability:

- present obligation

- arising from past events

Owners’ equity: the financial estimate of owners’ claims to the value in a business. Including:

- capital

- drawings

- income

- expenses

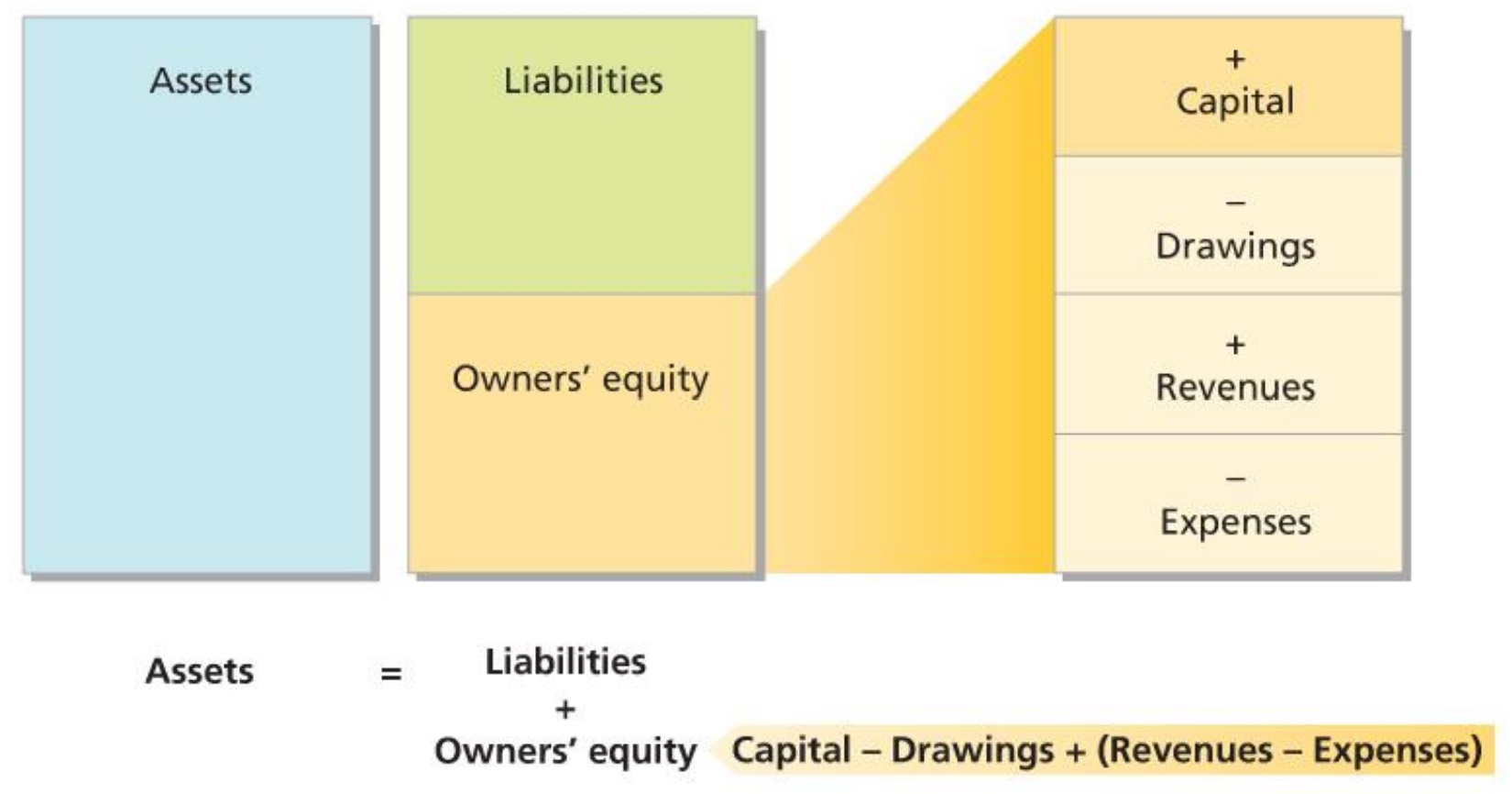

Double-entry accounting

Each transaction affects at least two accounts.

Format: T-account

Pattern:

Assets = Liabilities + Owners’ Equity

Debits = Credits

↓ Expansion of the accounting equation

Normal debit balance: Assets, expenses & drawings

Normal credit balance: Liabilities, capital & revenue

Recording transactions

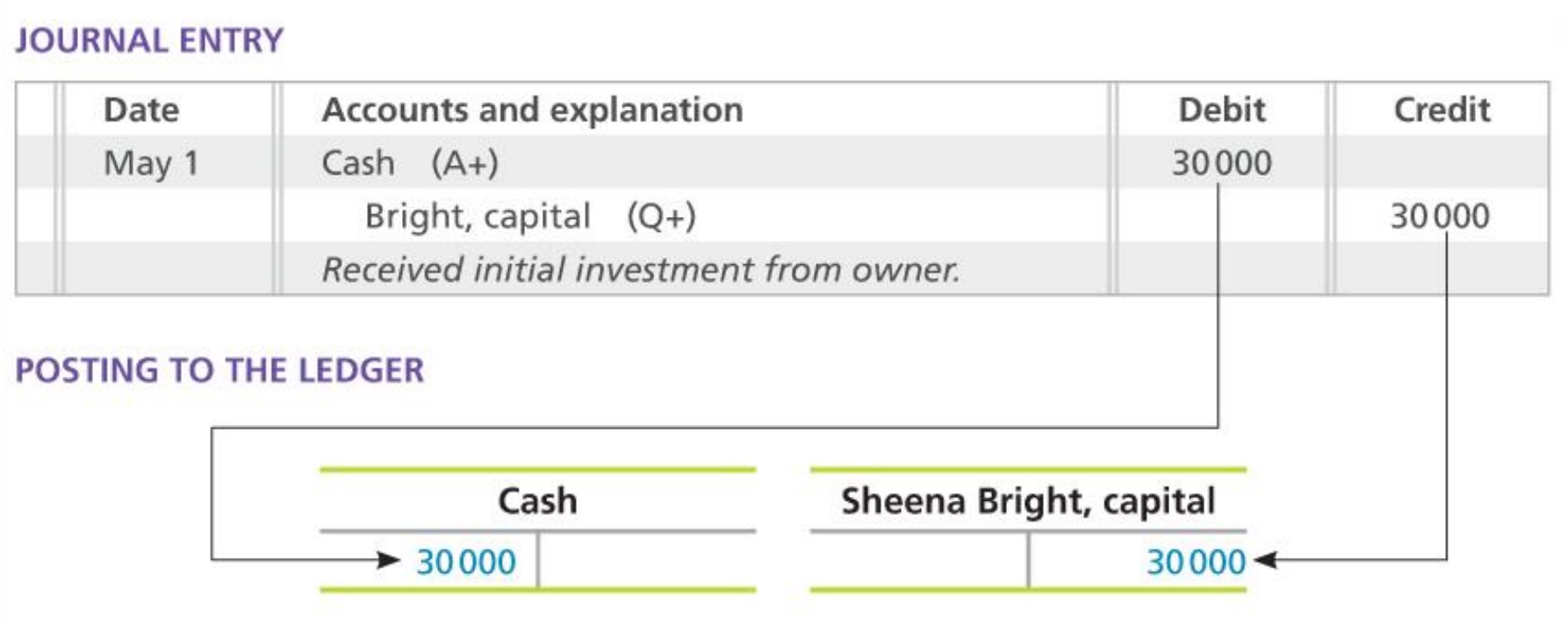

To record transactions in the journal:

- Identify the transaction from source documents.

- Specify each account affected by the transaction and classify it by type.

- Determine whether each account is increased or decreased by the transaction.

- Enter the transaction in the journal, including a brief explanation.

Example:

- On 1 May 2016, Sheena Bright starts the business titled ' Smart Touch Learning‘ by investing $30,000 cash in the business.

| Date | Accounts and explanation | Debit | Credit |

|---|---|---|---|

| May 1 | Cash Sheena Bright, Capital Received investment from owner | 30,000 | 30,000 |

| May 1 Dr. Cash 30,000 Cr. Sheena Bright, Capital 30,000 Received investment from owner |

↓ Copying (posting) information from the journal to the ledger

Flow of accounting information:

- Transaction occurs.

- Source documents prepared.

- Transactions analysis takes place.

- Transactions entered in journal.

- Amounts posted to ledger.

The trial balance:

- Summarises the ledger by listing all the accounts with their balances

- Total debits = Total credits (if not, there is an error)

To find errors, calculating the difference between total debits & total credits on the trial balance.